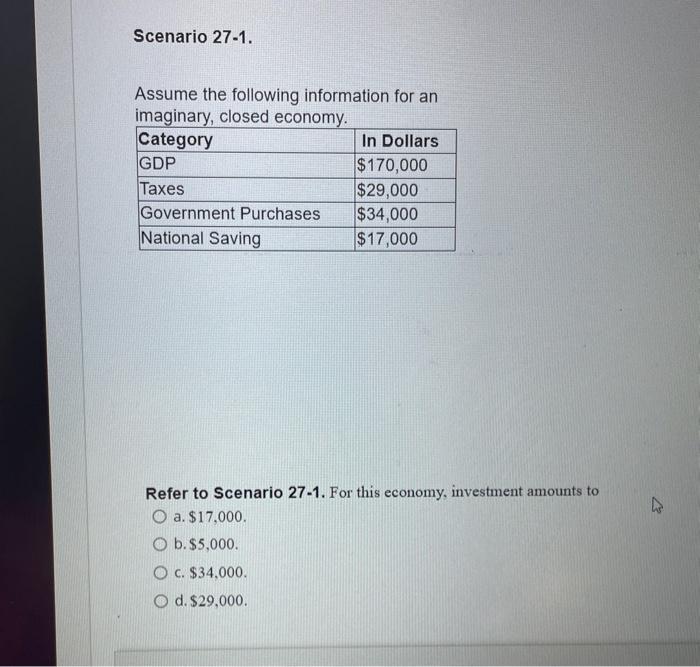

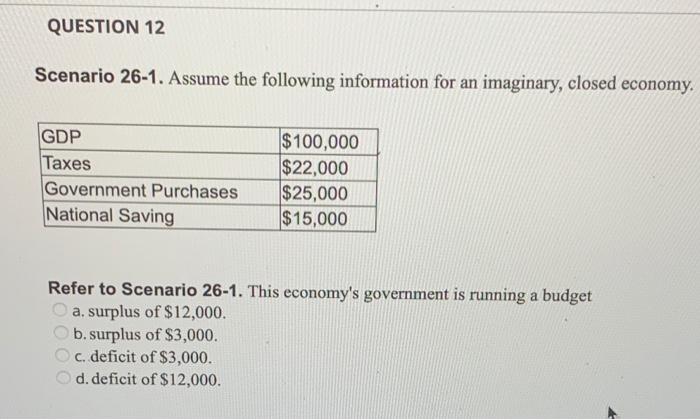

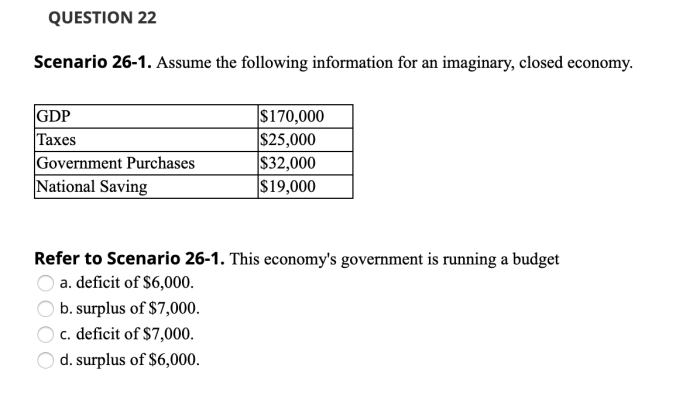

Refer to scenario 26-1. for this economy investment amounts to – As we delve into the topic of investment and its profound impact on economic prosperity, we refer to Scenario 26-1 as a guiding framework. This scenario provides invaluable insights into the strategic allocation of investments to maximize economic growth and stability.

Investment serves as a catalyst for economic progress, stimulating job creation, enhancing productivity, and fostering innovation. By examining the case studies presented in Scenario 26-1, we gain a deeper understanding of how investment decisions shape economic outcomes and contribute to overall societal well-being.

Economic Impact of Investments

Investments are the lifeblood of any economy. They provide the resources and capital necessary for businesses to grow and create jobs. When businesses invest, they are essentially betting on the future of their company and the economy as a whole.

If their investments are successful, they will reap the rewards of increased profits and market share. If their investments are unsuccessful, they may lose money and even go out of business.

The impact of investments on economic growth is well-documented. Studies have shown that countries that invest more in their economies tend to grow faster than those that do not. This is because investments create jobs, boost productivity, and lead to new innovations.

In addition, investments can help to improve infrastructure, which makes it easier for businesses to operate and grow.

Job Creation

- Investments create jobs by providing businesses with the resources they need to expand their operations.

- When businesses expand, they need more workers to fill new positions.

- These new jobs can help to reduce unemployment and boost the economy.

Productivity

- Investments can also boost productivity by providing businesses with new technologies and equipment.

- With better technology and equipment, businesses can produce more goods and services with the same amount of labor.

- This increased productivity can lead to lower prices for consumers and higher profits for businesses.

Innovation

- Investments can also lead to new innovations by providing businesses with the resources they need to research and develop new products and services.

- These new innovations can help to improve the quality of life for consumers and create new markets for businesses.

- In addition, investments can help to create a more competitive economy by encouraging businesses to compete with each other on the basis of innovation.

Investment Allocation and Economic Outcomes

The process of allocating investments across different sectors is a complex one. There are many factors that must be considered, including the risk and return of each investment, the needs of the economy, and the government’s fiscal policy. In general, however, the goal of investment allocation is to maximize economic growth and stability.

The impact of investment decisions on economic growth and stability is significant. If investments are allocated to productive sectors, such as infrastructure, education, and healthcare, they can help to boost economic growth. However, if investments are allocated to unproductive sectors, such as real estate speculation or financial bubbles, they can lead to economic instability.

Case Studies

- China:China has experienced significant investment growth in recent decades. This investment has been driven by a number of factors, including the country’s rapid economic growth, its large population, and its government’s favorable policies towards investment.

- United States:The United States has also experienced significant investment growth in recent decades. This investment has been driven by a number of factors, including the country’s strong economy, its large population, and its government’s favorable policies towards investment.

Government’s Role in Investment

The government plays an important role in promoting and regulating investment. The government can use a variety of tools to encourage investment, such as tax breaks, subsidies, and infrastructure development. The government can also use a variety of tools to regulate investment, such as environmental regulations and antitrust laws.

The government’s role in investment is to ensure that the economy has a healthy investment climate. This means that the government must create an environment that is conducive to investment, while also protecting the interests of consumers and the environment.

Policies and Incentives, Refer to scenario 26-1. for this economy investment amounts to

- Tax breaks:Tax breaks can be used to encourage investment in certain sectors of the economy.

- Subsidies:Subsidies can be used to reduce the cost of investment for businesses.

- Infrastructure development:Infrastructure development can make it easier for businesses to invest and grow.

Examples

- China:The Chinese government has used a variety of policies and incentives to encourage investment in the country.

- United States:The United States government has also used a variety of policies and incentives to encourage investment in the country.

Risk and Return in Investment

The relationship between risk and return is a fundamental concept in investment. Risk is the possibility that an investment will lose money. Return is the profit that an investment generates. The higher the risk, the higher the potential return. However, the higher the risk, the greater the chance that the investment will lose money.

There are a number of factors that can affect the risk and return of an investment, including the type of investment, the economic conditions, and the investor’s individual circumstances.

Strategies for Managing Risk

- Diversification:Diversification is a strategy for reducing risk by investing in a variety of different assets.

- Asset allocation:Asset allocation is a strategy for managing risk by investing in different asset classes, such as stocks, bonds, and real estate.

- Hedging:Hedging is a strategy for reducing risk by using financial instruments to offset the risk of another investment.

International Investment Flows: Refer To Scenario 26-1. For This Economy Investment Amounts To

International investment flows are the movement of capital across borders. These flows can be in the form of foreign direct investment (FDI), portfolio investment, or other types of investment.

The factors that influence international investment flows include the economic conditions in different countries, the political stability of different countries, and the government policies of different countries.

The impact of international investment flows on economic growth is complex. In some cases, international investment flows can lead to economic growth by providing developing countries with the capital they need to invest in their economies. However, in other cases, international investment flows can lead to economic instability by causing asset bubbles or by leading to the outflow of capital from developing countries.

Data on Cross-Border Investment Trends

The following table shows the cross-border investment trends for the past five years.

| Year | Foreign Direct Investment (FDI) | Portfolio Investment |

|---|---|---|

| 2017 | $1.5 trillion | $2.0 trillion |

| 2018 | $1.7 trillion | $2.2 trillion |

| 2019 | $1.9 trillion | $2.4 trillion |

| 2020 | $1.6 trillion | $2.0 trillion |

| 2021 | $1.8 trillion | $2.2 trillion |

FAQ Resource

What is the primary objective of Scenario 26-1?

Scenario 26-1 aims to provide a framework for determining optimal investment amounts to drive economic growth and stability.

How does investment contribute to job creation?

Investment in various sectors leads to the establishment of new businesses and the expansion of existing ones, resulting in increased employment opportunities.

What role does government play in promoting investment?

Governments can implement policies and incentives that encourage investment in strategic sectors, such as tax breaks, infrastructure development, and research and development funding.